It Pays to be Ship Shape

Compliant Employment & Payroll Specialists.

BREAKING: Client Dashboard – Real Time & Online makes Ship Shape the UK’s most transparent payroll provider BREAKING: £16M NMW Breaches To Be Repaid: Recruitment Sector High Risk BREAKING: Construction Identity Fraud & £60,000 Worker Fines BREAKING: Are Non-Compliant Recruitment Agencies Gaining A Competitive Edge?

Who are Ship Shape?

We are ‘tech savvy’ employment and payroll specialists, using our experience to provide transparent and compliance focused services to End Hirers, Agencies and Contractors since 2004

Established

UK Registered

Company

UK Bank

Accounts

Payments to UK

Accounts Only

Experian Rating

Low Risk

No Disqualified

Officers

Insurance

Cover

CIS Gross

Status

Full Audited

Accounts

Established

UK Registered

Company

UK Bank

Accounts

Payments to UK

Accounts Only

Experian Rating

Low Risk

Established

UK Registered

Company

UK Bank

Accounts

Payments to UK

Accounts Only

With our experience, gross status, professional legal and tax advisors, transparent systems and additional insurance protection for workers, Ship Shape will continue to be a trusted partner to our clients.

100% Compliance, No Compromise

|

Transparent Services Total transparency with no hidden risks; enabling you to focus on growth |

CIS

|

PEO

|

Umbrella

(PAYE) |

Payroll Bureau

(PAYE) |

|---|---|---|---|---|

|

Employment Model |

Self Employed

|

Employed |

Employed |

Varied |

|

Employed By |

N/A

|

Ship Shape |

Ship Shape |

Agency / End Hirer |

|

Employment Liabilities |

Contractor

|

Ship Shape |

Ship Shape |

Agency / End Hirer |

|

Tax Deductions |

CIS

|

PAYE |

PAYE |

PAYE |

|

Full Statutory Employment Rights |

|

|

|

Varied |

|

Pension Scheme Contributions |

|

|

|

|

|

Pension Scheme Management |

|

|

|

OPTIONAL |

|

Continuity Of Employment |

N/A

|

|

|

Varied |

|

Multiple Contract Flexibility |

|

|

|

Varied |

|

100% Compliance |

|

|

|

|

|

SDC Checks |

|

|

|

|

|

UTR Verification |

|

N/A |

N/A |

N/A |

|

Right To Work Checks |

|

|

|

OPTIONAL |

|

Incorrect Fuel Type Insurance |

|

|

|

|

|

Driver Negligence Insurance |

|

|

|

|

|

Payslip/Invoice |

|

|

|

OPTIONAL |

|

Daily Weekly Monthly Payroll |

|

|

|

|

|

24/7 Online Contractor Portal |

|

|

|

|

|

No Exit Costs, No Tie-in Period |

|

|

|

Varied |

- CIS

- PEO

- Umbrella

- Payroll Bureau

|

Transparent Services Total transparency with no hidden risks; enabling you to focus on growth |

CIS

|

|---|---|

|

Employment Model |

Self Employed

|

|

Employed By |

N/A

|

|

Employment Liabilities |

Contractor

|

|

Tax Deductions |

CIS

|

|

Full Statutory Employment Rights |

|

|

Pension Scheme Contributions |

|

|

Pension Scheme Management |

|

|

Continuity Of Employment |

N/A

|

|

Multiple Contract Flexibility |

|

|

100% Compliance |

|

|

SDC Checks |

|

|

UTR Verification |

|

|

Right To Work Checks |

|

|

Insurance Liability Check |

|

|

Incorrect Fuel Type Insurance |

|

|

Driver Negligence Insurance |

|

|

Payslip / Invoice |

|

|

Daily Weekly Monthly Payroll |

|

|

24/7 Online Contractor Portal |

|

|

No Exit Costs, No Tie-in Period |

|

|

Transparent Services Total transparency with no hidden risks; enabling you to focus on growth |

PEO

|

|---|---|

|

Employment Model |

Employed

|

|

Employed By |

Ship Shape

|

|

Employment Liabilities |

Ship Shape

|

|

Tax Deductions |

PAYE

|

|

Full Statutory Employment Rights |

|

|

Pension Scheme Contributions |

|

|

Pension Scheme Management |

|

|

Continuity Of Employment |

|

|

Multiple Contract Flexibility |

|

|

100% Compliance |

|

|

SDC Checks |

|

|

UTR Verification |

N/A

|

|

Right To Work Checkes |

|

|

Insurance Liability Check |

£21m Cover Inc

|

|

Accident Insurance |

|

|

Mobile SIM Card |

|

|

Payslip / Invoice |

|

|

Daily Weekly Monthly Payroll |

|

|

24/7 Online Contractor Portal |

|

|

No Exit Costs, No Tie-in Period |

|

|

Transparent Services Total transparency with no hidden risks; enabling you to focus on growth |

Umbrella

|

|---|---|

|

Employment Model |

Employed

|

|

Employed By |

Ship Shape

|

|

Employment Liabilities |

Ship Shape

|

|

Tax Deductions |

PAYE

|

|

Full Statutory Employment Rights |

|

|

Pension Scheme Contributions |

|

|

Pension Scheme Management |

|

|

Continuity Of Employment |

|

|

Multiple Contract Flexibility |

|

|

100% Compliance |

|

|

SDC Checks |

|

|

UTR Verification |

N/A

|

|

Right To Work Checkes |

|

|

Insurance Liability Check |

£21m Cover Inc

|

|

Accident Insurance |

|

|

Mobile SIM Card |

|

|

Payslip / Invoice |

|

|

Daily Weekly Monthly Payroll |

|

|

24/7 Online Contractor Portal |

|

|

No Exit Costs, No Tie-in Period |

|

|

Transparent Services Total transparency with no hidden risks; enabling you to focus on growth |

Payroll Bureau

|

|---|---|

|

Employment Model |

Varied

|

|

Employed By |

Agency / End Hirer

|

|

Employment Liabilities |

Agency / End Hirer

|

|

Tax Deductions |

PAYE

|

|

Full Statutory Employment Rights |

Varied

|

|

Pension Scheme Contributions |

|

|

Pension Scheme Management |

OPTIONAL

|

|

Continuity Of Employment |

Varied

|

|

Multiple Contract Flexibility |

Varied

|

|

100% Compliance |

|

|

SDC Checks |

|

|

UTR Verification |

N/A

|

|

Right To Work Checkes |

OPTIONAL

|

|

Insurance Liability Check |

|

|

Accident Insurance |

OPTIONAL

|

|

Mobile SIM Card |

|

|

Payslip / Invoice |

OPTIONAL

|

|

Daily Weekly Monthly Payroll |

|

|

24/7 Online Contractor Portal |

|

|

No Exit Costs, No Tie-in Period |

Varied

|

Compliant Supply Chain for All

Visible compliance throughout the supply chain; for you, your clients and HMRC

Customer Service That Cares

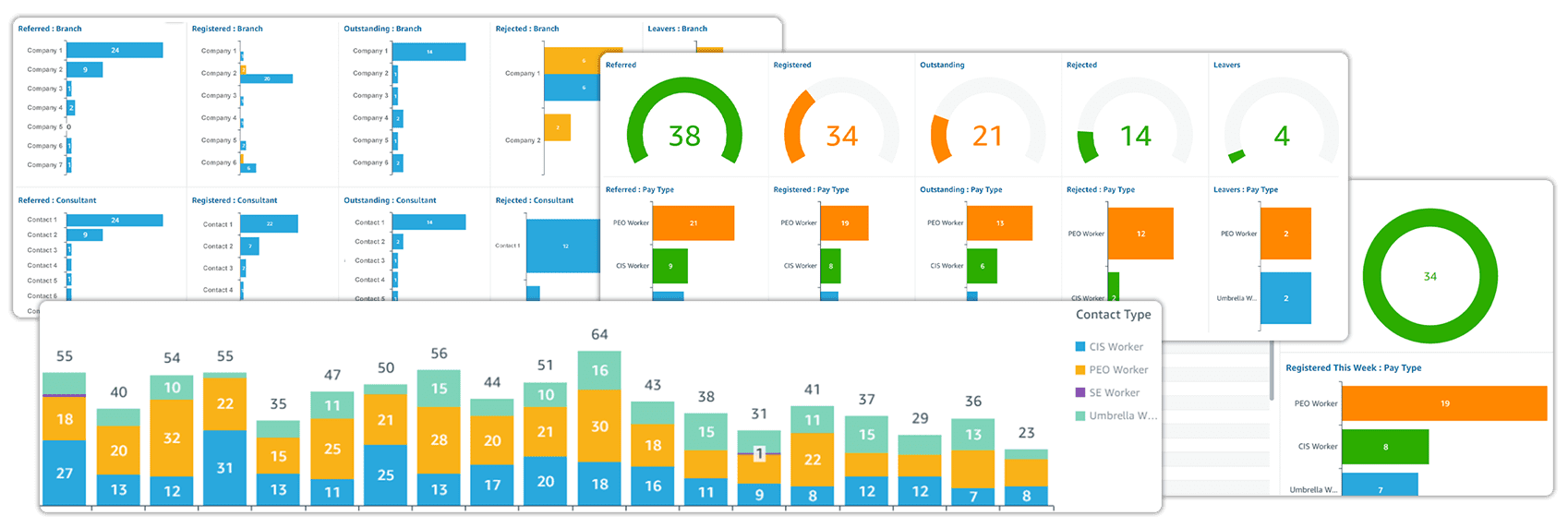

With our real-time reporting dashboards for customer service, you are kept up to date with referrals, registrations, rejections, leavers, compliance, payroll and invoices; providing you with full insight at every stage.

4.6

Proudly Supporting

We are committed to supporting Young Lives vs Cancer, see how our payroll donations are helping

Seas the Day

Copyright 2022 Ship Shape Resources Ltd